Global Direct-to-Consumer (D2C) Coffee Market, By Product Type (Ready to Drink, Soluble or Instant Coffee, Whole Beans, Coffee Pod and Capsules), By Packaging (Jars, Pouches/Sachets, Capsules/Pods and Ready to Drink (RTD)), By Distribution Channel (Online and Offline), By Subscription Model (Replenish, Access and Curation), By End User (Residential and Commercial), By Region, Competition, Forecast & Opportunities to 2027

- Last Updated: 18-Aug-2021 | | Report ID: AA0821088

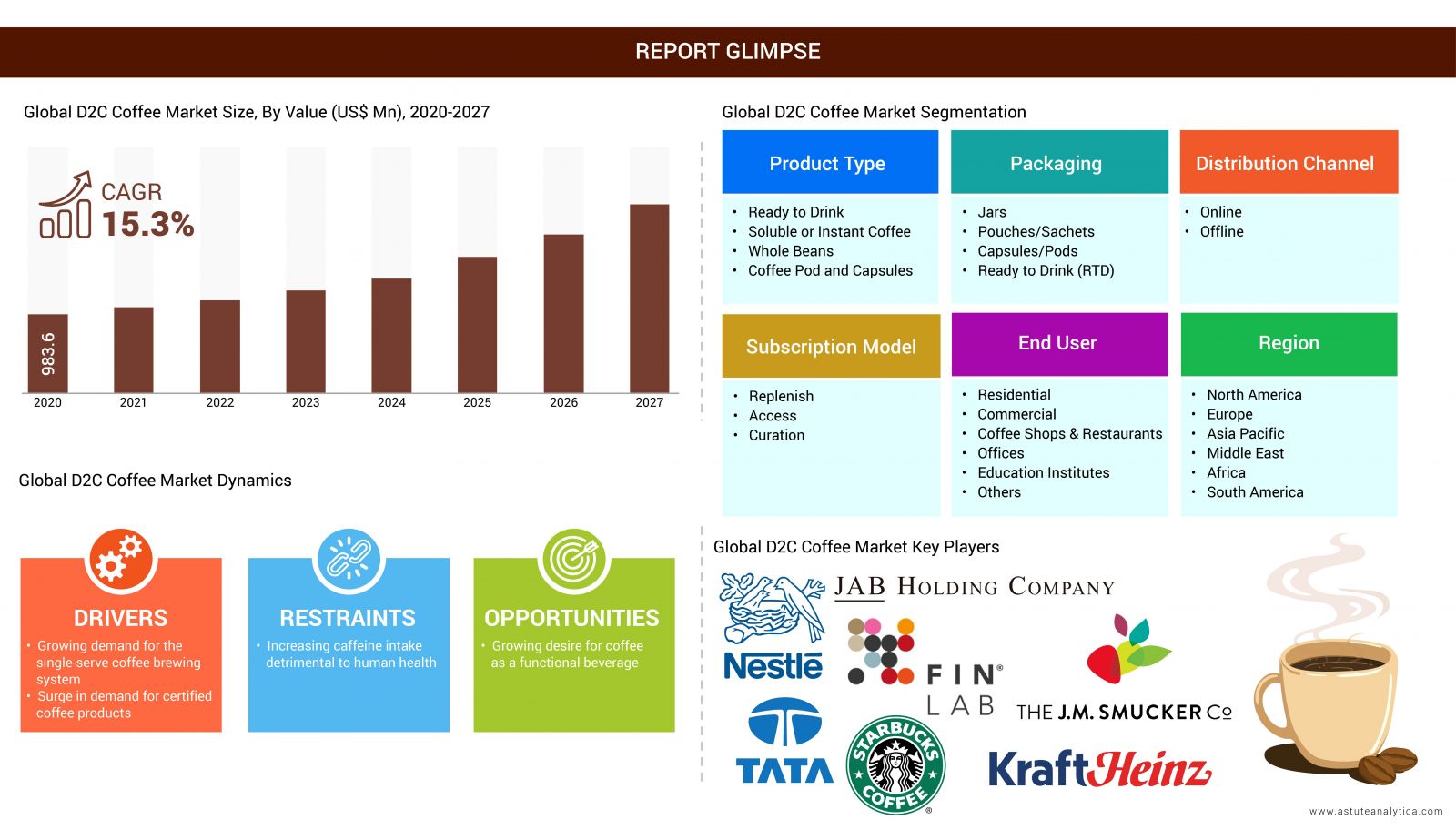

The global D2C coffee market generated a revenue of US$ 983.6Mn in 2020 and is forecast to grow at a compound annual growth of 15.3% from 2022 to 2027. On basis of the significant growth rate, the market is expected to record a revenue of US$ 2,722.3Mn by the end of the year 2027. The market growth over the forecast period reflects the recovery of the industry from Covid-19 and the subsequent growth trend. The research report offers analysis explained across 16 chapters totaling 253 pages, with 76 extensive data tables and 89 figures.

A surge of new direct-to-consumer (D2C or DTC) businesses is changing the way people purchase. These companies are fundamentally altering consumer preferences and expectations in the process. Direct-to-consumer firms have taken use of this infrastructure to expand quickly and engage with their customers directly. Direct-to-consumer companies manufacturers and transports their goods directly to customers, bypassing traditional retailers and other intermediaries. This enables D2C businesses to sell their products at cheaper prices than traditional consumer brands while maintaining complete control over the manufacturing, marketing, and distribution of their goods. D2C firms, unlike their traditional retail competitors, can experiment with distribution options such as shipping directly to customers, forming partnerships with physical stores, and launching pop-up shops. These are a few of the reasons in favor of the D2C model. It is observed that in cases where brand identity is powerful and consistent, consumers are loyal to a single message. As a result, marketing is incorporated into the product. The report on the global D2C coffee market provides a comprehensive analysis of market opportunities, market dynamics, and the competitive landscape of the industry. The global D2C coffee market is analyzed for the period of 2017 to 2027, wherein 2017-2020 are historic years, 2021 is considered as the base year, and 2022-2027 is the forecast period.

Coffee is the most widely consumed brewed beverage made from roasted coffee beans, which are the seeds of specific Coffee species. According to the International Coffee Organization (ICO), the world coffee consumption is expected to reach 169.34Mn bags in 2019/20, up 0.7 percent from 2018/19, while Covid-19 poses a significant downside risk to global coffee consumption. In the year 2019/20, demand for coffee was estimated to be 0.47Mn bags more than output, which is expected to be 168.86Mn bags. However, the situation is rapidly changing, with implications for both supply and demand. Many developing countries, such as India, have traditionally been tea-drinking countries, but in recent years, coffee has become a more popular beverage, with coffee shops and cafes such as Cafe Coffee Day, Barista Cafe and Restaurant, Costa Coffee, Starbucks Coffee Company, among others, gaining popularity. As a result of the pandemic-induced panic among consumers, marketers are experimenting with various methods to communicate directly with customers via internet platforms. Several young firms have also begun offering online classes to teach millennials how to make coffee at home with reasonable ease. Also, many popular D2C coffee start-ups in the world have sprung up in response to the increased popularity of various types of coffee.

The ever-increasing digital impact may appear to be a result of the COVID-19 pandemic, according to sources. However, it has been found that more than a third of consumers bought directly from the manufacturer's website. In the next five years, nearly two-fifths of their purchases will be directed to D2C brands, according to 40% of them. And this occurred long before COVID-19 was implemented. Brands can use a digital approach to lead a data-driven marketing plan. They can design customer funnels, feedback loops, and assess consumer insights and behaviors across a variety of digital platforms using this strategy. Previously, each of these activities would take a business month, if not years, to complete. Everything now happens in real-time and in a more coherent manner.

Report Scope

The research report provides an exhaustive analysis of the market opportunities in the global D2C coffee market. Geographically, the D2C market is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa to track growth opportunities. The research report identifies that because of rising coffee consumption in the region's developed countries, Europe dominates the D2C market. According to a survey conducted by the Institute for Scientific Information on Coffee (ISIC), 68% of respondents said they drank coffee while working on a regular basis. In January 2021, Nespresso unveiled its World Explorations line of coffees, which are accessible through Nespresso's D2C online shop. Meanwhile, Starbucks-branded products from Nescafé and Nestlé are generally purchased in stores or through third-party online merchants. The company's coffee brands sold well in worldwide markets such as North America, Europe, and other regions. Sales of Nespresso have increased by 17%.

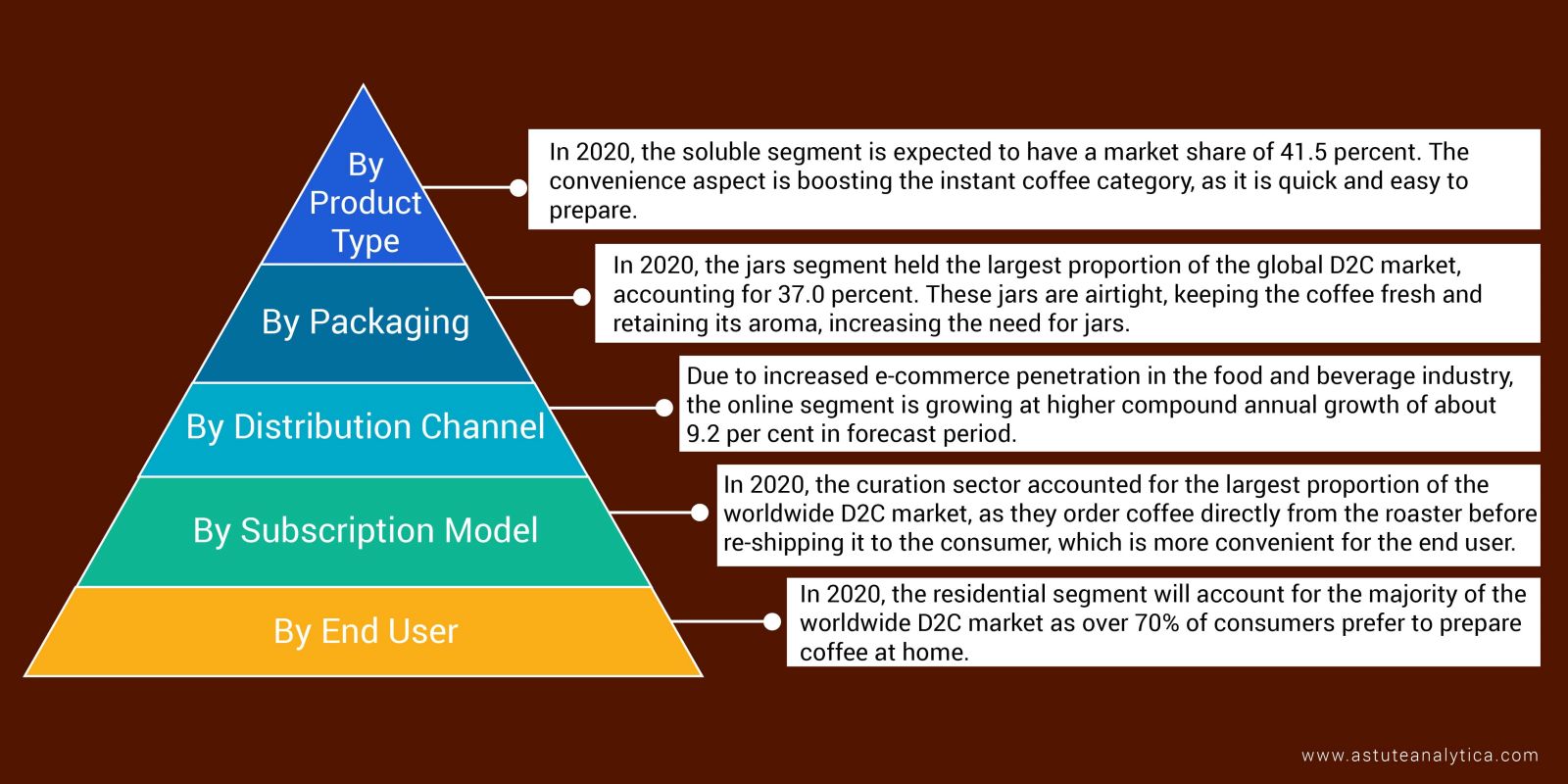

The research report includes a global D2C coffee market analysis based on the following variables – product type, packaging, distribution channel, subscription model, and end-user. It will help the individuals or businesses associated with the D2C coffee market to identify the right market for their products. It offers a comprehensive textual and graphical analysis of dominating particulars for each segment.

An easy-to-understand value chain analysis, global and regional opportunities, and market dynamics are all included in the research. It also illustrates how to use Porter's five forces analysis to assess the impact of a variety of factors on the global market, including supplier bargaining power, competitor competitive intensity, the threat of new entrants, the threat of substitutes, and buyer bargaining power. To examine the key factors like political, economic, social, technological, legal, and environmental affecting the market, the report includes a section dedicated to a PESTLE analysis. Following the high-level analysis section, the report includes the Covid-19 impact study and a comprehensive chapter of company profiles.

Covid-19 Impact Analysis

The revenue generated by the global D2C coffee market is expected to expand considerably by the end of the year 2027. COVID-19 could have a positive impact on the direct-to-consumer (D2C) sector. Manufacturers foresee a customer shift toward RTD coffee as an alternative to freshly brewed coffee because of the pandemic, which might enhance the D2C market's sales performance even more. The report includes covid-19 impact study at four levels including pre-covid (2017-2019), Short Term (2020-21), Mid Term (2022-24), and Long Term (2025-2027).

Report Glimpse

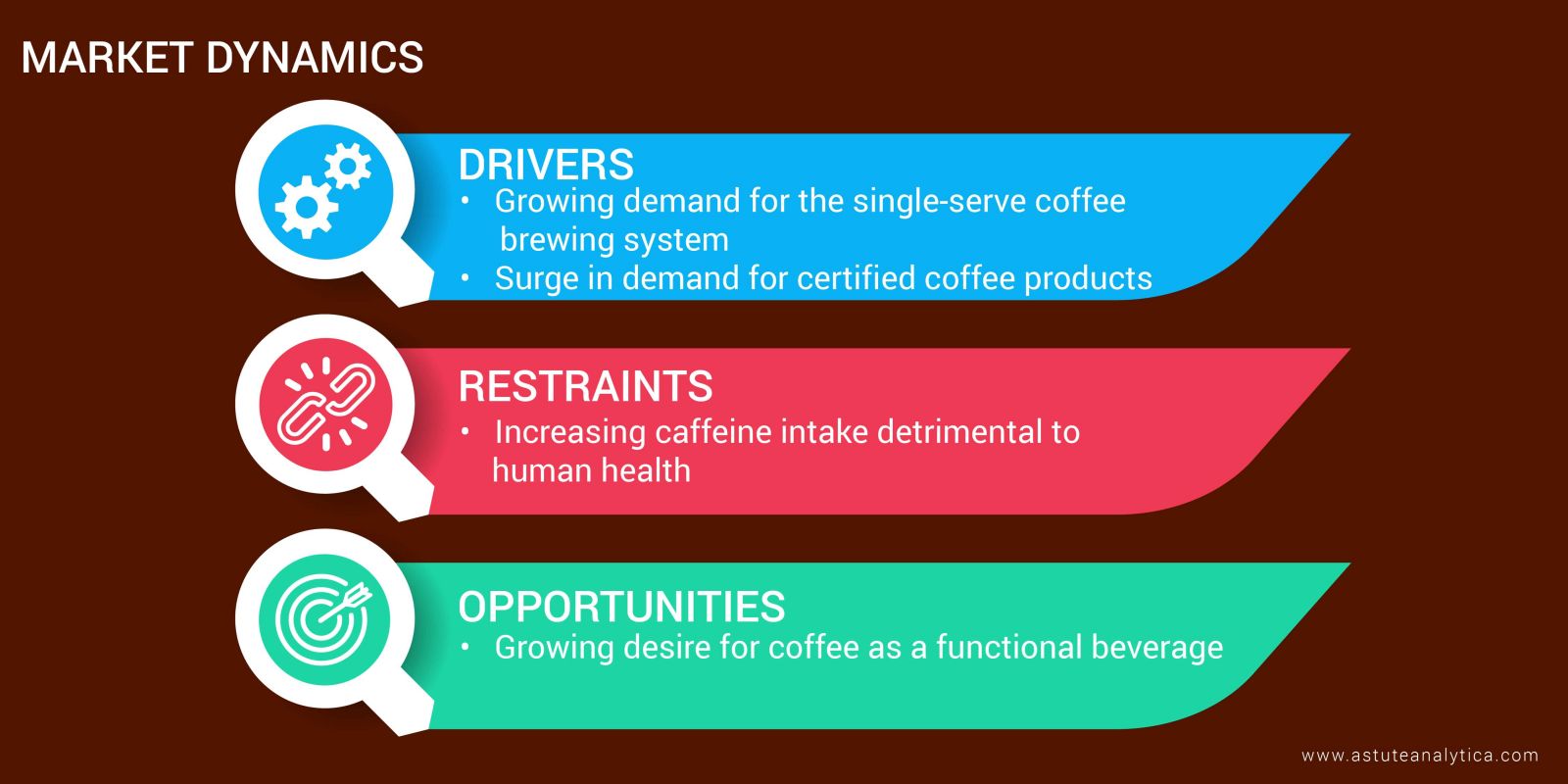

The market has observed a tremendous rise with the growing demand for the single-serve coffee brewing system. In the case of coffee, accessible forms like coffee pods and capsules, as well as RTD coffee, are becoming increasingly popular among the general public, particularly in North America and Western Europe, as a way to make delicious coffee at home in less time. Also, certified coffee is in high demand because it provides consumers with assurances about the product's reliability. While coffee is becoming a more prevalent target for food counterfeiters. certifications provide consumers with a variety of third-party assurances. They can also vouch for environmentally responsible farming techniques, up to and including organic certification. However, coffee market growth and sales are likely to be stifled by a growing number of health-conscious consumers and the negative health effects linked with excessive caffeine usage.

Competition Landscape

The competition landscape section of the report offers an in-depth analysis of key players active in the global Direct-to-consumer (D2C) coffee market via primary as well as secondary research that covers descriptive profiles of 14 prominent players and the list can be customized as per the reader’s research requirements. Details covered for these players include – Business Description, Product Portfolio, Company Financials and Claims, Key Details, Strategy Outlook, and Recent Developments. The players profiled in the research report include are – Bean Box, Blue Bottle, Craft Coffee, Gevalia, La Colombe Torrefaction, Inc., Nestle, Pact Coffee, Peet’s Coffee, Spinn Inc., Sudden Coffee, Tata Consumer Products Limited, Tandem Coffee, and Vega Coffee. The report also covers D2C coffee startups enlisting the basic overview of the companies.

Segmentation Outlook of the Global D2C Coffee Market

By Product Type

- Ready to Drink

- Soluble or Instant Coffee

- Whole Beans

- Coffee Pod and Capsules

By Packaging

- Jars

- Pouches/Sachets

- Capsules/Pods

- Ready to Drink (RTD)

By Distribution Channel

- Online

- Offline

By Subscription Model

- Replenish

- Access

- Curation

By End-User

- Residential

- Commercial

- Coffee Shops and Restaurants

- Offices

- Education Institutes

- Aviation & Transportation

- Other Commercial Places

By Geography

- North America

- The U.S.

- Canada

- Mexico

- Europe

- The UK

- Germany

- France

- Italy

- Spain

- Russia

- Poland

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

REPORT SCOPE

| Report Attribute | Details |

|---|---|

| Market Size Value in 2020 | US$ 983.6Mn |

| Expected Revenue in 2027 | US$ 2,722.3Mn |

| Historic Data | 2017-2020 |

| Base Year | 2021 |

| Forecast Period | 2022-2027 |

| Unit | Value (USD Mn) |

| CAGR | 15.3% |

| Segments covered | By Product Type, Packaging, Distribution Channel, Subscription Model, End-User, and Region |

| Key Companies | Bean Box, Blue Bottle, Craft Coffee, Gevalia, La Colombe Torrefaction, Inc., Nestle, and other prominent players |

| Customization Scope | Get your customized report as per your preference. Ask for customization |

FREQUENTLY ASKED QUESTIONS

This report provides analysis of global market for D2C coffee for the period 2017 to 2027, wherein 2017-2019 represent historic data, 2020 has been considered as base year and is on actuals. 2021 has been estimated for recent concluded quarter, while 2021-2027 are forecast values, reflecting impact of different factors on the growth trend.

The D2C coffee market is growing at a CAGR of 15.3% over the forecast period.

Fitness-oriented consumers must consume nutritious beverages on a regular basis, and they must eat meals regularly throughout the day. As a result, demand for healthy single-serve coffee products is growing among the public at large.

The factors like the increasing number of health-conscious consumers and negative health problems associated with the excessive consumption of caffeine are expected to restrain the growth and sales of coffee and hence impede the growth of its D2C market.

Coffee, being a consumable commodity, is subject to food and beverage rules in practically every jurisdiction on the planet. This means it's subject to a slew of regulations governing how it's stored, transported, and brewed. Furthermore, because coffee includes a significant amount of caffeine, it is subject to caffeine guidelines in several countries.

Asia Pacific is growing at the highest CAGR of about 9.4% over 2021- 2027.

The global direct-to-consumer coffee market is seen as competitive, but it is expected to consolidate over the forecast period.

Due to the intensively demanding setting in the coffee business, where various companies are working to develop new product offerings to meet the tastes and preferences of global consumers, there is a lot of room for gaining a competitive edge through innovation. Companies are developing new and improved coffee blends all throughout the world, increasing rivalry among them.

The report covers the following segments; product type, packaging, distribution channel, subscription model and end user.

Curation segment contributed the major share of 56.3% in the global D2C market in 2020 with a market value of US$ 69,202.8 million.

Nestle, JAB Holding, FinLav, The JM Smucker, The Kraft Heinz, Tata, Starbucks and others are the major companies operating in D2C coffee Market.

There are many start-ups in the North America, mainly in the United States including The Grind Roasters, Blue Bottle, BrewBird, Blossom Coffee and others.

The key strategies adopted by market players hover around inorganic growth for market expansion, which includes Mergers and acquisitions, partnerships, regional expansion. Leading players are however inclined towards new product development allowing them first mover advantage and setting market growth curve.

COVID-19 could have a positive impact on the direct-to-consumer (D2C) sector. Manufacturers foresee a customer shift toward RTD coffee as an alternative to freshly brewed coffee as a result of the pandemic, which might enhance the D2C market's sales performance even more. Retail demand for food and beverage items is expected to be strong in 2020, according to companies like Nestlé SA.

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)

_Coffee_Market.jpg)