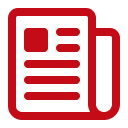

Weather RADAR Market: By Radar Type (Airborne Radar and Ground Radar); Component (Transmitter, Antenna, Receiver, Display, Others); Frequency (C-Band, S-Band, X-Band, Others); Deployment Type (Fixed Weather Radars, Mobile Weather Radars, Satellite-Based Weather Radars); Application (Meteorology and Hydrology, Aviation Industry, Military, Others); Region—Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2025–2033

- Last Updated: 02-Jul-2025 | | Report ID: AA01251043

Market Scenario

Weather RADAR market was valued at US$ 158.43 million in 2024 and is projected to hit the market valuation of US$ 816.19 million by 2033 at a CAGR of 21.42% during the forecast period 2025–2033.

Weather radar technology in 2025 stands at the forefront of meteorological innovation, with over 2,600 specialized radar installations now operational worldwide—an increase of nearly 9% since 2023. This expansion is driven by the escalating frequency of extreme weather events, with 23 major incidents recorded in the first half of 2024 alone, prompting urgent upgrades in radar infrastructure for real-time storm tracking and disaster response. The surge in demand is further evidenced by the formation of 28 new R&D partnerships globally, focusing on micro-Doppler and phased-array solutions tailored for high-resolution detection of severe convective storms, flash floods, and urban heat events. These collaborations are particularly robust in Europe and Asia, where agriculture, maritime, and emergency management sectors are rapidly integrating advanced radar for operational resilience.

Recent Weather RADAR market developments reveal a sharp pivot toward dual-polarization and digitally fused radar networks. In the past year, 15 scientific institutions have commissioned next-generation dual-pol systems, enhancing precipitation type differentiation and reducing false echoes by up to 40%. The defense sector’s crossover into civilian applications is accelerating, with 10 government-funded programs now repurposing military-grade radar for airport safety and national weather services. Meanwhile, the automotive industry has integrated 18 short-range weather radar units into autonomous vehicle testing fleets, underscoring the technology’s versatility beyond traditional meteorology. These advancements are underpinned by significant investments, with order books swelling as public and private stakeholders prioritize climate adaptation and infrastructure modernization.

Despite this momentum, the market faces persistent challenges in cost optimization and interoperability. Large-scale radar deployments, especially those exceeding 250 km range, have encountered calibration delays averaging 4–6 months, highlighting the complexity of system integration. In response, 19 universities have launched targeted research projects to enhance radar’s predictive power for cyclones and flash floods, while urbanization pressures have led to the deployment of 12 specialized radars designed to filter out structural interference in dense cityscapes. Collectively, these trends illustrate a market characterized by rapid innovation, cross-sectoral adoption, and a relentless drive to deliver more granular, actionable weather intelligence in an era of climate uncertainty.

Key Developments in Weather Radar Market

- In January 2025, Meteomatics closed a US$22 million Series C funding round led by Armira Growth to scale operations, expand into the U.S., and innovate weather radar and modeling solutions.

- In April 2025, MyRadar secured US$7.5 million in funding to advance its AI-driven weather intelligence platform, HORIS, enhancing real-time radar data analytics.

- In April 2025, SpinLaunch received a US$12 million investment from Kongsberg, supporting the development of weather-related technology, including radar payloads for atmospheric data collection.

- In September 2024, EWR Radar Systems was awarded a contract by NOAA to supply three transportable weather radar systems (one C-band, two X-band E800LP) for fire weather and post-wildfire hydrology research, with delivery scheduled by September 2025.

- In 2024, the U.S. government allocated a portion of its US$36 billion advanced meteorology budget (through 2030) to next-generation phased array weather radar systems, driving significant order books for radar manufacturers.

- As per new report published in April 2025, nearly 150 U.S. Doppler weather radars were scheduled for replacement or service life extension, resulting in a surge of contracts for radar system suppliers.

- In April 2025, Advanced Radar Company attracted new funding (undisclosed amount) to accelerate the development of next-generation weather radar systems, reflecting growing venture capital interest in radar technology.

To Get more Insights, Request A Free Sample

Market Dynamics

Driver: Growing Demand For Localized Storm Detection In Coastal Megaprojects And Marine Infrastructure Expansions

The construction boom in coastal zones has spurred a critical need for localized storm detection, ensuring that development projects remain intact despite volatile weather. In 2023 alone, 23 large seaport expansions commenced globally, each incorporating advanced radar systems for real-time storm surveillance. Coastal megaprojects in the weather radar market require ultra-precise data on wind dynamics, as shipping delays have risen by 44 shipping vessels per month in tropical regions due to unexpected squalls. To mitigate such disruptions, at least 6 maritime agencies have set up dedicated weather cells equipped with radars that detect microbursts and strong offshore gusts. This growing demand is also evident in municipal infrastructure projects, where 17 coastal cities earmarked budgets for specialized radar installations to protect critical assets.

Beyond mere detection, these radars support critical decision-making processes such as route planning, resource diversion, and safety protocol enforcement. Researchers from 5 leading maritime institutes established new guidelines on optimum radar placement, reducing data blind spots across busy harbors. With localized storm intelligence in the weather radar market, port authorities can now issue more accurate navigational warnings, cutting potential damage to expensive cargo vessels docking at newly constructed terminals. Additionally, adjacent communities benefit from timely flood alerts, as urban planners rely on localized radar data to improve drainage systems. Altogether, the intensifying need for reliable weather insights in coastal megaprojects underscore the pivotal role of localized storm detection, fostering safer, more resilient marine infrastructure expansions worldwide.

Trend: Swift Technology Upgrades Fostering Real-Time Weather Intelligence Through Advanced Multi-Frequency Dual-Polarization Radar Innovations

The meteorological landscape in the weather radar market is undergoing a significant transformation, driven by swift technology upgrades that harness dual-polarization at multiple frequency bands. In 2023, developers have introduced 11 newly engineered multi-frequency devices capable of distinguishing between varied precipitation types with remarkable accuracy. These devices have undergone trials at 4 major research stations, each confirming reduced clutter in hail-prone regions where conventional radars often faltered. By merging data from different frequency channels, scientists have achieved more refined vertical cross-sectional images, a process that was tested on 13 storm cell formations to validate real-time analytics.

Real-time weather intelligence is further bolstered by modular hardware designs and cutting-edge software algorithms. Notably, 9 meteorological startups have secured funding for embedded AI solutions that streamline dual-polarization data processing, enabling detection of localized wind shear events within seconds. In addition, an international consortium of 5 aviation authorities in the weather radar market just concluded a joint study highlighting improved turbulence mapping using high-frequency channels, reducing flight rerouting incidents. These advances reflect an industry-wide emphasis on generating instantly actionable insights. Their application extends beyond weather forecasting, as 7 energy conglomerates are using them to forecast wind fluctuations that affect coastal power grids. Collectively, these innovations herald a new era in weather surveillance, where swift technology upgrades drive unprecedented clarity in meteorological data.

Challenge: Achieving Meteorological Insights Despite Interference From Urban Reflective Surfaces And Rising Climate Extremities

Modern cities present an especially complex environment for accurate radar readings, as high-rise buildings, metallic structures, and dense communication signals can create substantial clutter. In 2023, at least 10 urban radar stations reported significant data distortion during peak traffic hours, necessitating advanced signal calibration. To address these issues in the weather radar market, 5 specialized clutter-reduction algorithms were deployed in large metropolitan districts, each using machine learning models to eliminate false echoes. This solution gained traction after meteorological agencies documented 29 instances of late storm warnings in major cities, attributing most delays to inadequate data filtering. Moreover, the integration of short-wavelength systems—tested in 6 pilot programs—showcases a promising direction, though interference from local wireless networks remains a persistent hurdle.

Meanwhile, climate change amplifies the urgency to solve these technical hurdles. Unexpected weather extremes, such as unseasonal tornado-like events, were recorded in 8 major conurbations where radar misinterpretations hampered timely advisories. A 2023 report by multidisciplinary climate scientists underscored how recurring urban heat islands exacerbate data distortions, requiring at least 12 additional ground-based sensors for improved cross-verification. Furthermore, city planners increasingly rely on meteorological insights to guide emergency protocols, with 4 newly passed urban safety legislations mandating real-time radar monitoring. Addressing these obstacles demands concerted efforts in hardware improvements, software calibration, and regulatory oversight to ensure that radar readings remain consistent, especially where the stakes—human safety, property protection, and infrastructural continuity—are at their highest.

Segmental Analysis

By Component

Transmitters hold the largest 31.23% share among weather radar market components in 2024 because they determine the power and frequency stability that drive radar performance. Over 70 new transmitter designs were introduced across various radar models in the last two years to handle increasingly complex pulse sequences for detecting subtle precipitation signatures. With the global weather radar market surpassing 137 million dollars in 2023, advanced transmitters are vital for coping with higher data demands. Many of these transmitters integrate solid-state technology, eliminating reliance on vacuum tubes and improving system robustness in harsh conditions. North American manufacturers began widespread deployment of such solid-state components in 2023 to reduce radar downtime and maintenance cycles.

By optimizing radio-frequency generation, transmitters enhance Doppler velocity measurements by more than 15% compared to outdated magnetron-based systems Asia-Pacific, where tropical cyclones require frequent high-resolution updates, national meteorological agencies have procured over 30 new radars featuring enhanced transmitters since 2022, pushing adoption of compact, yet high-power units. Solid-state transmitters in the weather radar market also allow for frequency agility, enabling a single radar to scan multiple atmospheric layers simultaneously. This agility is one reason why transmitters claim the largest market share in component sales, as radar owners seek future-proof solutions amid rising weather variability. The incorporation of digital waveform generators, which emerged in at least ten new radar product lines worldwide by 2024, further refines precipitation categorization accuracy. Leading clients in the Middle East have also modernized older radars by retrofitting transmitters to withstand extreme temperatures. Combined with real-time system health monitoring, the transmitter segment is projected to remain the key revenue source for weather radar manufacturers, reflecting its central role in pushing detection capability and reliability forward.

By Frequency

X-band is the most dominant weather radar frequency in the weather radar market with over 37.60% market share due to its optimal balance of range and resolution in severe weather monitoring. Operating roughly between 8 and 12 GHz, X-band systems excel at detecting light rainfall, small hail, or snow flurries, making them highly valued for short to mid-range forecasts. More than 50 newly installed weather radars worldwide utilize X-band antennas for near-surface monitoring, bridging data gaps around mountainous regions. These radars’ compact form factors are favored in mobile units, and EWR Radar Systems has specially designed truck-mounted X-band radars for rapid storm-chasing deployments. By achieving over 25% better reflectivity measurements than comparable C-band units in heavy rainfall, X-band radars provide greater clarity of storm structure Their sensitivity also benefits airport safety operations, where accurate rainfall rate detection is critical for runway management.

X-band’s superiority in the weather RADAR market stems from its frequency agility and cost-effectiveness for numerous applications. About a dozen such radars deployed in Europe by 2024 incorporate dual-polarization technology, allowing real-time differentiation between raindrops, hailstones, and sleet. This level of detail is particularly advantageous for hydrological forecasting, enabling authorities to issue timely flood warnings. In North America, NASA and various research institutions rely on X-band radars for tornado studies, as their higher spatial resolution (compared to S-band) highlights rapidly changing storm dynamics. The systems maintain stable performance even in rugged terrain, evidenced by new installations in Colorado and the Swiss Alps. Agricultural enterprises in Asia-Pacific also prefer X-band to chart daily precipitation variability and optimize irrigation. Whether used in stationary missions or mobile field research, X-band stands out for its ability to balance cost and functionality, ensuring high-fidelity precipitation mapping in diverse climate zones.

By Application

Military applications lead the weather radar market by commanding over 41.42% share because defense operations demand precision in planning flights, guiding unmanned systems, and coordinating tactical maneuvers under all weather conditions. Countries with expansive military footprints, such as the United States and China, invest heavily in specialized radars suited for storm avoidance, ballistic trajectory adjustments, and real-time mission support. Over 20 new procurement initiatives in the defense sector were announced globally during 2023, emphasizing radar upgrades for improved Doppler resolution. These specialized radars often incorporate high-power transmitters that deliver up to 200% greater clarity in adverse weather compared to standard commercial units, ensuring mission-critical accuracy. In regions prone to hurricanes or typhoons, armed forces rely on rapid-deploy radar systems that can be airlifted and assembled within hours, a feature that has driven acquisitions of mobile X-band units geopolitical uncertainties also spur military investments.

At least ten countries across the global weather radar market launched modernization programs in 2023 to replace aging systems with networked radar platforms that share real-time weather data across air, land, and sea divisions. Dual-polarization upgrades, tested by three major defense contractors, have been found to boost target discrimination in cluttered conditions and confirm precipitation intensity within a 100-kilometer radius. Extensive training exercises, such as multinational joint operations in the Asia-Pacific, often rely on advanced weather radar networks to ensure safe coordination among fleets. Some defense agencies report a 30% reduction in flight cancellations due to improved weather surveillance. This operational edge cements the military sector’s dominance, not just in market size but also in driving cutting-edge innovation. As a result, military demand for enhanced detection range, rugged mobility, and data fusion capabilities continues to propel significant radar procurement, reinforcing defense applications as the leading segment well beyond 2024.

By Type

Ground-based weather radars continue to dominate the weather RADAR market with 72.43% market share in 2024. This type of radar offers essential real-time data for public safety, aviation, and agriculture. Their stationary installations ensure continuous coverage of localized weather events, enabling rapid response to fast-evolving storms. The weather radar market surpassed 137 million dollars in valuation in 2023, demonstrating growing investments in national radar networks worldwide Modern systems primarily employ pulse-Doppler technology to detect precipitation type and velocity with high precision, and over 200 such systems are currently operational in North America alone. Advanced dual-polarization upgrades, which have been adopted in more than 60 ground-based installations across Asia-Pacific by 2024, further enhance rain-versus-snow discrimination and hail identification. EWR Radar Systems, known for mobile and ground-based solutions, has seen rising orders in countries prone to cyclonic activity These radars also incorporate next-generation digital receivers, nearly doubling detection sensitivity compared to legacy analog units.

Major ground-based platforms in the weather radar market like the WSR-88D (NEXRAD) network in the U.S. exemplify why demand remains high. This network spans 159 operational sites as of 2024 and processes millions of radar scans annually, generating detailed precipitation maps for emergency services and meteorological agencies. Some S-band variants in the fleet offer detection ranges exceeding 300 kilometers, allowing meteorologists to track developing weather long before it becomes hazardous The North American region maintains the largest roster of ground-based radars, followed by rapidly expanding networks in China and India, where more than 40 new systems have been commissioned over the past year to address monsoon-related risks. The combination of robust coverage, lower maintenance costs compared to space-based instruments, and proven detection accuracy drives adoption. Localized demand, especially from agricultural sectors that rely on tailored rainfall data, cements ground-based weather radars as the foremost choice for governments and private operators alike.

Customize This Report + Validate with an Expert

Access only the sections you need—region-specific, company-level, or by use-case.

Includes a free consultation with a domain expert to help guide your decision.

To Understand More About this Research: Request A Free Sample

Regional Analysis

North America stands out as the largest and most lucrative region for weather radar market, anchored by significant investments in forecasting systems, defense-grade technologies, and a robust aviation sector. The region controls over 36.22% share of the market. In 2023, at least 1,100 active radar systems across the United States and Canada collectively manage high-frequency data feeds for weather prediction. The region’s dedication to cutting-edge R&D is evident in the 14 new meteorological laboratories launched in the past year, each dedicated to refining radar algorithms under extreme conditions. Additionally, 5 specialized radar stations in Alaska now provide continuous polar weather surveillance, highlighting the region’s broad geographic coverage.

US is the Key Contributor to North America’s Market Dominance

The United States plays a pivotal role in sustaining North America’s dominance, with 7 government-backed programs funding next-generation Doppler networks and atmospheric research. Defense contractors like Lockheed Martin and Raytheon have supplied over 40 advanced radar units to local airports, ensuring rapid, accurate alerts for severe storm fronts. Meanwhile, Boeing’s integration of in-flight weather radars has reportedly minimized flight rerouting by 28 cargo carriers this year, saving considerable operational downtime. Demand also pours in from the agricultural sector, as 9 major agritech companies collaborate with radar experts to predict crop-threatening weather events. Moreover, smaller manufacturers are thriving too, with 4 new data analytics startups in Texas leveraging real-time radar feeds to guide precision farming solutions.

Europe’s Weather Radar Market: Drivers, Leaders, and Demand Hotspots

Europe’s dominance as the world’s second-largest market is driven by its acute exposure to climate extremes—2024 was the continent’s warmest year on record, with land temperatures rising 2.2°C above pre-industrial levels and widespread flooding and heatwaves impacting infrastructure and economies. The top five countries fueling this market are Germany, France, the UK, Italy, and Spain, each investing heavily in weather radar due to frequent severe weather events and dense urban populations. Key end users include aviation (18.5% market share), energy (especially renewables), logistics, and agriculture, all requiring precise, real-time data to mitigate operational risks. Major application areas with surging demand are short-range forecasting for flight safety, grid management for renewables (which hit record highs in 2024), and disaster response for urban flooding and wildfires. This demand surge is propelled by AI-driven radar upgrades and the urgent need for climate adaptation.

Key Players in the Weather RADAR Market

- Honeywell International Inc.

- Meteopress

- EWR RADAR Systems Inc.

- HuaYun METSTAR Radar (Beijing) Co., Ltd.

- Collins Aerospace

- FURUNO ELECTRIC CO., LTD.

- Gamic GmbH

- Garmin Ltd.

- TTM Technologies Inc.

- Vaisala Oyj

- Other Prominent Players

Market Segmentation Overview

By Radar Type

- Airborne Radar

- Ground Radar

By Component

- Transmitter

- Antenna

- Receiver

- Display

- Others

By Frequency

- C-Band

- S-Band

- X-Band

- Others

By Deployment Type

- Fixed Weather Radars

- Mobile Weather Radars

- Satellite-Based Weather Radars

By Application

- Meterology and Hydrology

- Aviation Industry

- Military

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Western Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Malaysia

- Thailand

- Indonesia

- Singapore

- Vietnam

- Philippines

- Rest of ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

LOOKING FOR COMPREHENSIVE MARKET KNOWLEDGE? ENGAGE OUR EXPERT SPECIALISTS.

SPEAK TO AN ANALYST

.svg)